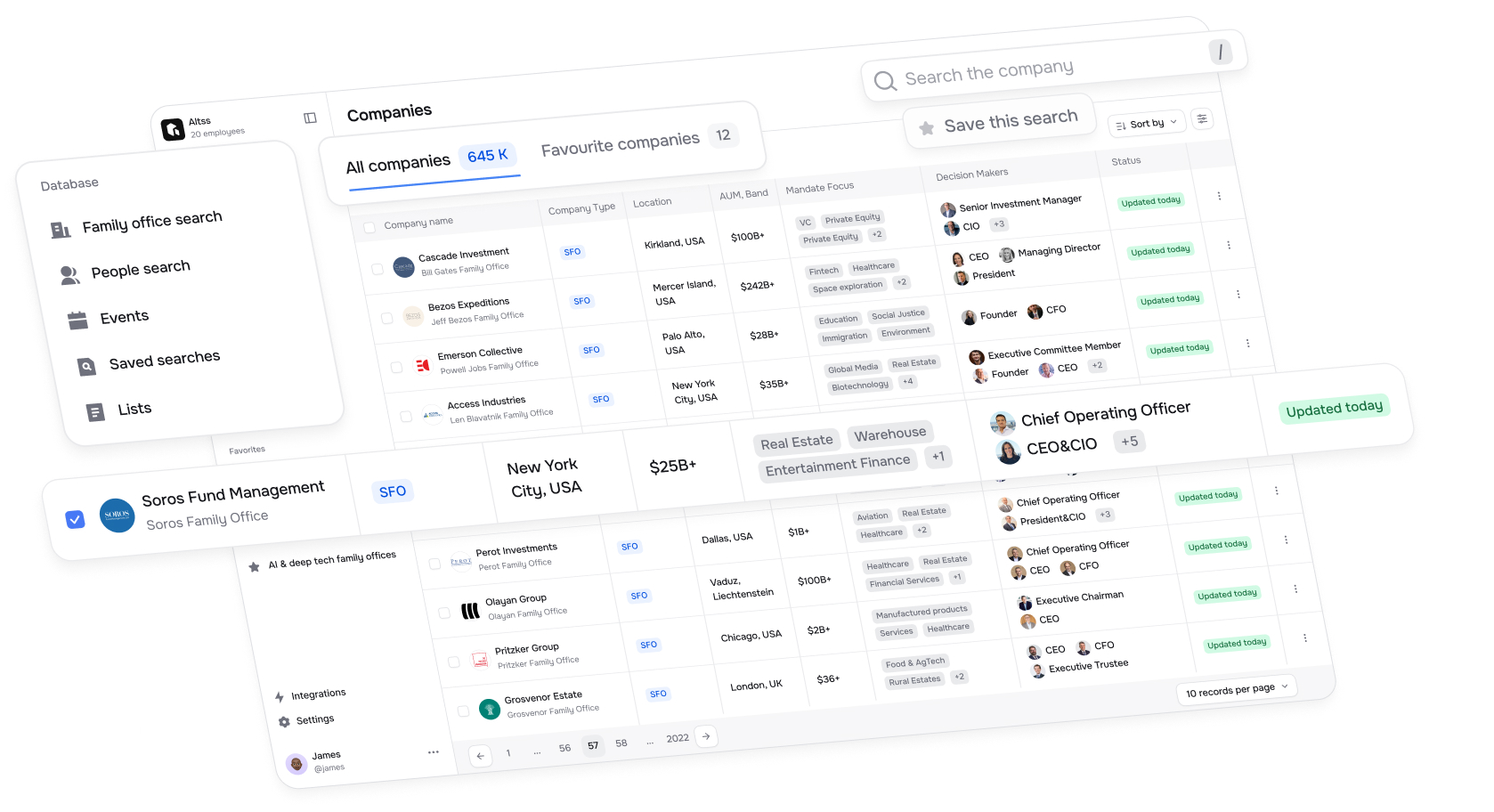

Data visibility platform gives LPs structured access to live dealflow — new fund launches, secondaries, co-investments — with no transaction fees or brokerage.

MIAMI, FL, UNITED STATES, February 17, 2026 /EINPresswire.com/ — Altss, the OSINT-powered allocator intelligence platform for private markets, today announced LP-GP Connect — a data visibility platform that gives institutional investors and family offices structured access to live investment opportunities across private markets before they reach broader distribution. LP-GP Connect supports every major vehicle and entity type: venture capital, private equity, growth equity, private credit, real estate, infrastructure, secondaries, continuation vehicles, co-investments, SPVs, search funds, venture studios, syndicates, and direct deals.

The Fundraising Access Problem

Private markets fundraising has more channels than ever — and none of them solve the visibility problem from the allocator’s side. Existing LP relationships and capital introduction desks are limited to warm networks. Placement agents charge approximately 2% of committed capital and still only reach the LPs they already know. Outbound channels — cold outreach through LP databases, roadshows, conferences, LinkedIn, and content — are GP-initiated and volume-dependent. Digital distribution platforms have expanded access to the wealth channel but do not serve institutional allocators looking for direct fund exposure. Every channel available today pushes opportunities from the GP outward. None of them give allocators a way to pull dealflow toward themselves.

The result is a structural mismatch. Emerging managers launching debut funds compete for allocator attention against established franchises with decades of LP relationships and dedicated investor relations teams. Allocators outside the traditional GP network — a family office in Southeast Asia, a pension fund outside the top 50, an endowment building a new alternatives allocation — have no structured way to discover opportunities that match their mandate. The same gap extends to secondaries, where $240 billion in 2025 transaction volume, according to Jefferies, still depends on proprietary networks that exclude the majority of qualified buyers, as well as co-investments, direct lending mandates, real estate syndications, and infrastructure deals.

Data Visibility, Not Brokerage

LP-GP Connect is a data visibility platform — not a broker-dealer, not a placement agent, and not an advisory intermediary. The platform charges no transaction fees, no success fees, and no carried interest. Fund managers, sponsors, lenders, secondaries specialists, and operators present live opportunities to a verified allocator audience of over 30,000 institutional investors and family offices worldwide. Allocators discover opportunities based on strategy, vehicle type, sector, geography, and mandate alignment. Every interaction is structured and opt-in. Allocator privacy is preserved by design.

Allocator-initiated discovery represents a distinct category from LP databases, placement agents, capital introduction programs, digital distribution platforms, and networking events. Each of those channels operates from the GP side outward. LP-GP Connect inverts the model — giving allocators direct visibility into live dealflow across every asset class and vehicle type in private markets, on their terms, on their timeline, with full control over engagement.

“We come from intelligence operations, not finance. When we looked at how private markets fundraising actually works, the inefficiency was obvious. A fund manager launching a new vehicle and a family office looking for that exact strategy can exist in the same market for years and never find each other — because there is no shared infrastructure connecting supply and demand. Databases sell contact lists. Placement agents sell introductions. Neither of them solves the underlying visibility problem. LP-GP Connect is a data layer that sits underneath all of it — no fees, no brokerage, no intermediation — and gives both sides of the market a way to find each other across new fund launches, secondaries, co-investments, and every other vehicle type in private markets.”

— Dawid Siekiera, Founder, Altss

LP-GP Connect is built on top of the Altss allocator intelligence platform, which provides verified coverage of over 30,000 institutional investors and family offices worldwide. Altss combines regulatory filings, public disclosures, and proprietary OSINT methodology to maintain sub-30-day data freshness — including decision-maker contacts with 99%+ email deliverability, allocation mandates, and investment activity signals. The platform serves fund managers, asset managers, and investment banks across venture capital, private equity, private credit, real estate, infrastructure, and real assets.

About Altss

Altss is an allocator intelligence platform for private markets. Founded in 2025 by a team with backgrounds in cybersecurity operations and large-scale open-source intelligence, Altss applies intelligence-grade methodology to LP discovery — delivering verified decision-maker data, mandate signals, and source-linked profiles refreshed on a sub-30-day cadence. The platform covers 30,000+ institutional investors and family offices worldwide, with the deepest verified family office dataset in the market at 9,000+ profiles. Headquartered in Miami.

Website: https://altss.com

Book a demo: https://altss.com/book-demo

Media Contact:

Tatiana Ledovskikh

pr@altss.com

Dawid Siekiera

Altss

contact@altss.com

Visit us on social media:

LinkedIn

Bluesky

X

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()