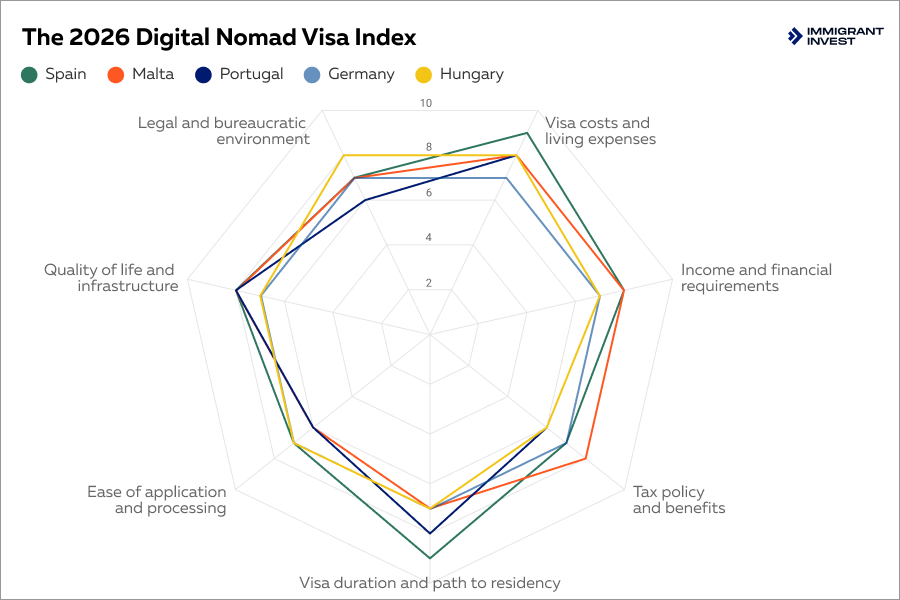

The Digital Nomad Visa Index 2026 – top countries for remote workers seeking residency by Immigrant Invest, an international consulting company

WASHINGTON, D.C., DC, UNITED STATES, February 17, 2026 /EINPresswire.com/ — In January 2026, Immigrant Invest, an international consulting company, published the Digital Nomad Visa Index 2026.

The index focuses on key factors such as income requirements, processing timelines, tax treatment, and residence conditions. This helps remote workers understand where residency conditions are most favourable in 2026.

Best-performing digital nomad destinations

Based on the overall score, the Digital Nomad Visa Index 2026 identifies several countries that consistently perform well across all criteria.

The highest-ranking destinations are all European, which reflects strong legal frameworks and predictable residence rules:

1. Spain, offering a regulated Digital Nomad Visa with a preferential tax regime and one of the lowest income requirements.

2. Malta, providing a dedicated Nomad Residence Permit with 0% tax on foreign income and an English-speaking legal and business environment.

3. Portugal, allowing remote workers to combine the D8 visa with long-term residence prospects and access to one of Europe’s most stable relocation frameworks.

4. Germany, enabling remote professionals to legalise long-term residence through the freelance route, with access to Europe’s largest economy and a highly regulated legal environment.

5. Hungary, offering the White Card programme with moderate income requirements, fast processing, and one of the lowest costs of living in the EU.

The index focuses on practical usability rather than lifestyle appeal alone. Countries score higher when rules are transparent, processing timelines are predictable, and long-term planning is possible. This approach helps digital nomads choose destinations that support stability rather than short-term stays.

Key findings from the Digital Nomad Visa Index 2026

The index highlights the continued expansion of Digital Nomad Visas programmes worldwide. By 2026, it includes more than 50 operational options, with several new visas introduced in 2024, including Italy.

‘With more than 50 operational visas analysed, the index reflects a clear shift in how governments approach remote workers,” says Elena Ruda, Chief Development Officer at Immigrant Invest. “Digital nomads are increasingly viewed as long-term residents who contribute foreign income without competing for local employment.”

Income requirements vary significantly across ranked countries.

Among the top 15 destinations, monthly thresholds range from no minimum income in jurisdictions such as the Bahamas to around $4,167 in higher-cost countries.

Several European digital nomad visas fall within a mid-range bracket and usually require between €2,700 and €3,700 per month. This range accommodates both freelancers and higher-income remote professionals.

Application timelines vary widely across digital nomad visa programmes. According to the index, processing periods range from around 30 days to over 90 days, depending on the country and the chosen application route.

Some Digital Nomad Visas rely on quick online procedures and offer relatively fast approvals, while others require consular processing, which extends the overall timeline to 3—4 months. As a result, processing speed remains a critical factor in relocation planning.

• Europe dominates the top positions in the index, with Spain, Malta, and Portugal leading the overall ranking. These countries combine clear legal frameworks with predictable residence conditions.

• In Latin America, the strongest performers within the top 15 include Mexico, Costa Rica, and Colombia, which offer comparatively lower income thresholds and simpler administrative procedures.

• In Asia, Thailand remains a popular destination among digital nomads but ranks lower in the index. This is due to significantly higher income and asset requirements under its long-term residence routes, which limit accessibility despite strong lifestyle appeal.

Tax treatment represents one of the most significant differences between Digital Nomad Visa options.

• The index includes jurisdictions with 0% personal income tax, such as the UAE and the Bahamas, alongside countries applying standard progressive tax rates, including Germany and Italy.

• Some destinations, such as Spain, combine preferential tax regimes for foreign income with standard taxation on locally sourced earnings. These variations have a direct impact on net income outcomes for remote workers.

Methodology overview

The index uses a multi-criteria assessment to compare Digital Nomad Visas across income thresholds, validity, processing timelines, tax treatment, and family inclusion rules. These criteria reflect the practical decisions digital nomads face when selecting a country.

To ensure accuracy, the index relies on publicly available, official information issued by national authorities and includes only legally established, operational programmes with clearly defined eligibility and residence conditions.

The methodology turns legal data into clear comparisons. Digital nomads can review countries side by side and understand which options match their income level, mobility needs, and long-term plans.

About Immigrant Invest

Immigrant Invest is an international сonsulting company specialising in residence and citizenship by investment. We work with investors, entrepreneurs, and globally mobile professionals. Our experts analyse migration law changes and relocation programmes worldwide.

The Digital Nomad Visa Index 2026 serves as a starting point for relocation planning. It helps narrow down suitable countries before legal and tax consultations. The full text can be found on the Immigrant Invest website.

The Digital Nomad Visa Index 2026 by Immigrant Invest group of authors:

Mohamed Zakaria, Senior Investment Migration Expert

Fact checked by Avril Blanchette, Investment Migration Advisor

Reviewed by Vladlena Baranova, Head of Legal & AML Compliance Department, CAMS, IMCM

Elena Ruda

Immigrant Invest

+356 2033 0178

digital@immigrantinvest.com

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()